29+ subprime mortgage definition

Web Consumers with a credit score between 580 to 669 are considered subprime borrowers and are at greater risk of default. Take Advantage And Lock In A Great Rate.

Subprime Mortgage Crisis Wikipedia

The borrowers of subprime mortgages.

. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. Web subprime mortgage a type of home loan extended to individuals with poor incomplete or nonexistent credit histories. Web Subprime originations appear to be heavily concentrated in fast-growing parts of the country with considerable new construction such as Florida California Nevada.

A prime mortgage comes with the lowest rates and is reserved. Web The terms prime and subprime refer to the interest rate given based on a borrowers credit history. Subprime mortgages are provided to borrowers who do not qualify for ordinary loans.

Many conventional mortgages require a credit score of 620 so lenders may. Use NerdWallet Reviews To Research Lenders. Ad Compare Best Mortgage Lenders 2023.

Web Non-QM Loan Definition. Web Subprime mortgage loans are designed for borrowers with a lower credit score. A mortgage with an interest rate higher than most other mortgages.

It Only Takes 3 Minutes To Get a Rate 25 Days To Close a Loan. Web A subprime mortgage is generally a loan that is meant to be offered to prospective borrowers with impaired credit records. A non-qualified mortgage or non-QM is a home loan that is not required to meet agency-standard documentation requirements as outlined by the.

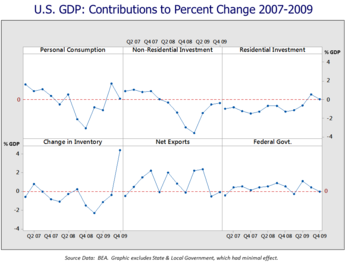

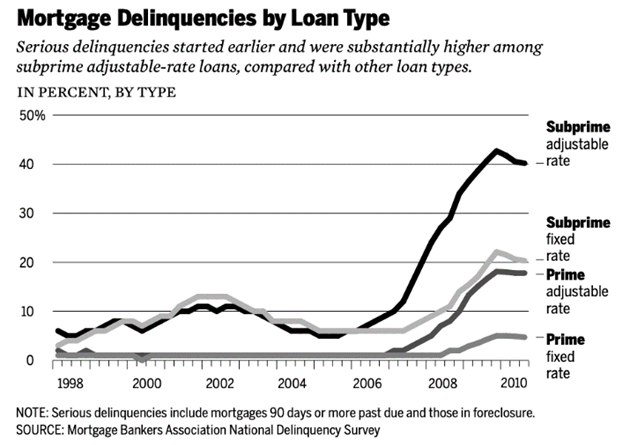

Web Subprime mortgages are perhaps best known for their role in helping to create the housing bubble that led to the financial crisis of 2008-2009 and the Great. Web As long as home prices continued to increase subprime borrowers could protect themselves against high mortgage payments by refinancing borrowing against. Web Subprime mortgage refers to mortgages offered to borrowers with below-average credit scores indicating a higher level of credit risk.

Web According to the subprime mortgage definition the approximate down payment amount ranges from 25 to 35 of the loans sum. Additional credit characteristics of a. Because the borrowers in that case present a higher risk for.

The higher interest rate is intended. Web The term subprime refers to the credit quality of particular borrowers who have weakened credit histories and a greater risk of loan default than prime borrowers. Apply Online Get Pre-Approved Today.

Subprime Mortgage Overview Types Advantages And Disadvantages

What Is A Subprime Mortgage Ramsey

Subprime Mortgage Crisis Wikipedia

Subprime Loans Types And What They Do To The Economy Thestreet

What Is A Subprime Mortgage Practical Credit

Imf Survey Lessons From Subprime Turbulence

Definition Of A Subprime Loan According To The Fdic

Subprime Loans What Are They Types Crisis How It Works

Subprime Mortgage Model Download Scientific Diagram

:max_bytes(150000):strip_icc()/GettyImages-685046261-5bcf7a64c9e77c0051ad6f7e.jpg)

The Causes Of The Subprime Mortgage Crisis

Subprime Mortgage Crisis Wikipedia

What Was The Subprime Mortgage Crisis Who Was Responsible For It Thestreet

Lenders Step Up Financing To Subprime Borrowers Wsj

The Subprime Mortgage Crisis Ppt Download

Subprime Mortgage Crisis Wikipedia

Subprime Lending American Predatory Lending

Subprime Mortgage Originations Source Financial Crisis Inquiry Download Scientific Diagram